AKA the Halvening

Approximately every four years, the rewards paid to Bitcoin miners are cut in half per block mined, hence the "halving"; this is the core basis for Bitcoin's store of value. In combination with [[Supply#Supply/Bitcoin|Bitcoin's finite supply structure]], this feature is what makes [[Bitcoin#Bitcoin the Digital Asset|Bitcoin the digital asset]] a truly disinflationary money supply.

Technically speaking, the Bitcoin supply is reduced (i.e. "halved") every 210,000 blocks. The mechanism maintaining this halving schedule is the [[Difficulty]], which is adjusted about every two weeks to maintain an average block interval time of ten minutes.

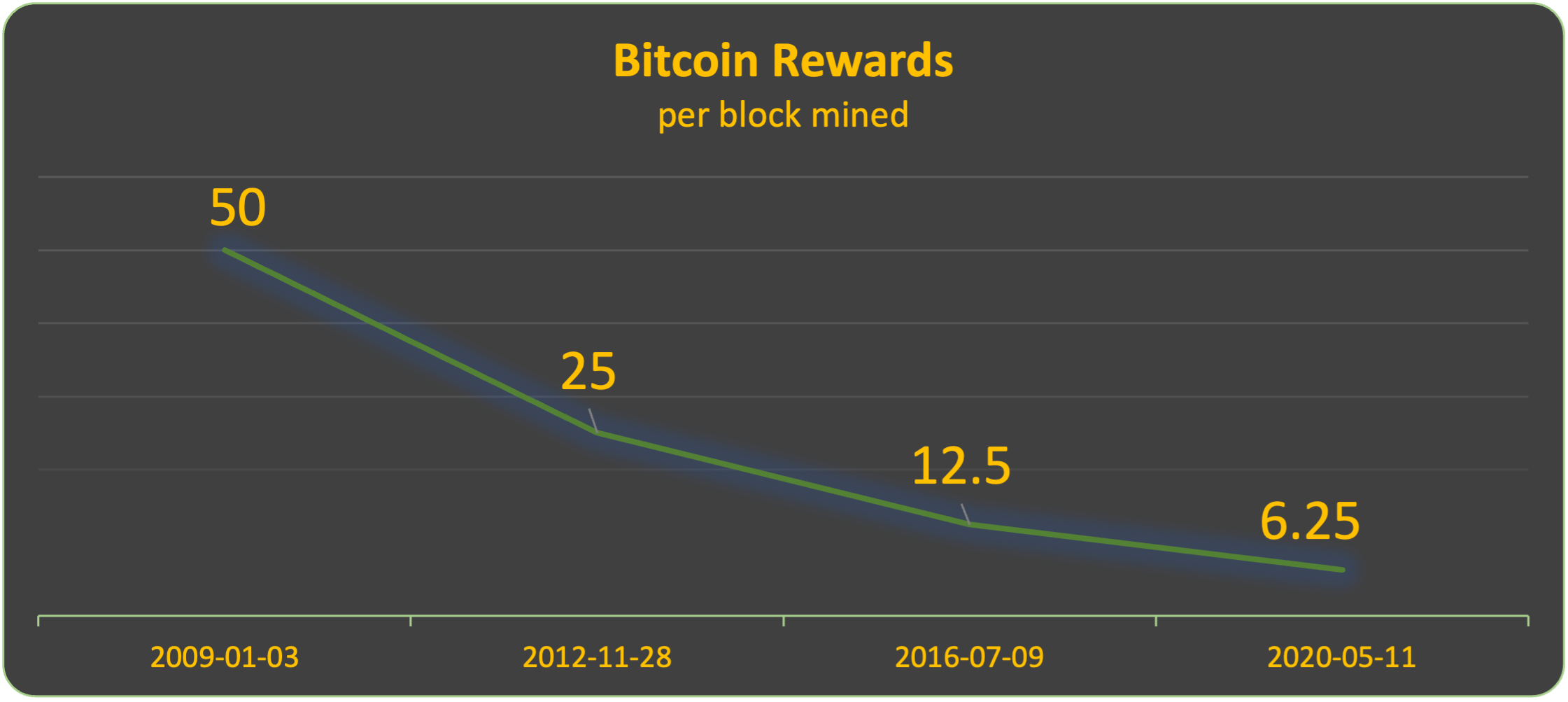

1. The [first 210,000 blocks](https://www.blockchain.com/btc/block/000000000000048b95347e83192f69cf0366076336c639f9b7228e9ba171342e) were mined on the 28th of November, 2012 (UTC), at which time Bitcoin mining rewards per block were halved from 50 BTC to 25 BTC.

2. The [second 210,000 blocks](https://www.blockchain.com/btc/block/000000000000000002cce816c0ab2c5c269cb081896b7dcb34b8422d6b74ffa1) were mined on the 9th of July, 2016 (UTC) at block 420,000, at which time Bitcoin mining rewards per block were halved from 25 BTC to 12.5 BTC.

3. The [third 210,00 blocks](https://www.blockchain.com/btc/block/000000000000000000024bead8df69990852c202db0e0097c1a12ea637d7e96d) were mined on the 11th of May, 2020 (UTC) at block 630,000, at which time the Bitcoin mining rewards were halved from 12.5 BTC to 6.25 BTC.

4. Estimating with current average block interval times, the fourth halving will likely occur in late April of 2024 at block 840,000.

In economics, these halving events cause a _shift of the supply curve_. Effectively, this sends supply shockwaves throughout the monetary network, and these ripple effects can be felt for some time. To compound these effects, the scarcity in the [[Supply#Supply/Bitcoin|Bitcoin supply]] largely drives demand and, at least in macroeconomic theory, serves as a hedge against inflation (ceteris paribus).

> The Bitcoin halving event can create a seismic shift in network hashpower that is proportional to the rate changes in its supply.

Now - when a halving occurs, miners are competing for fewer Bitcoin, and many will ramp up operations; this increases [[Hashpower]], which increases the mining difficulty, network security, and theoretically, the value of Bitcoin itself. Other miners may also stop participating in the network as the operating costs are too high (they may temporarily switch to other [[Proof of Work]] chains depending on the price of Bitcoin). Miner behavior notwithstanding, the effect of the halving is also highly anticipated by traders who will preemptively stock up on Bitcoin in between halvings.

All of these supply and demand pressures have historically converged to create an environment in which Bitcoin is a highly sought-after asset. All else held constant, the law of supply and demand then dictates that the value of Bitcoin will increase in post-halving market cycles. History has shown these properties of Bitcoin to be resilient and time-tested, across years of global pandemic uncertainty, and even while many endure wartime.